How to Calculate Beta of a Portfolio

In the example 2 times 01667 equals 03334 and 13 times 08333 equals 1083. To calculate the beta of a portfolio you need to first calculate the beta of each stock in the portfolio.

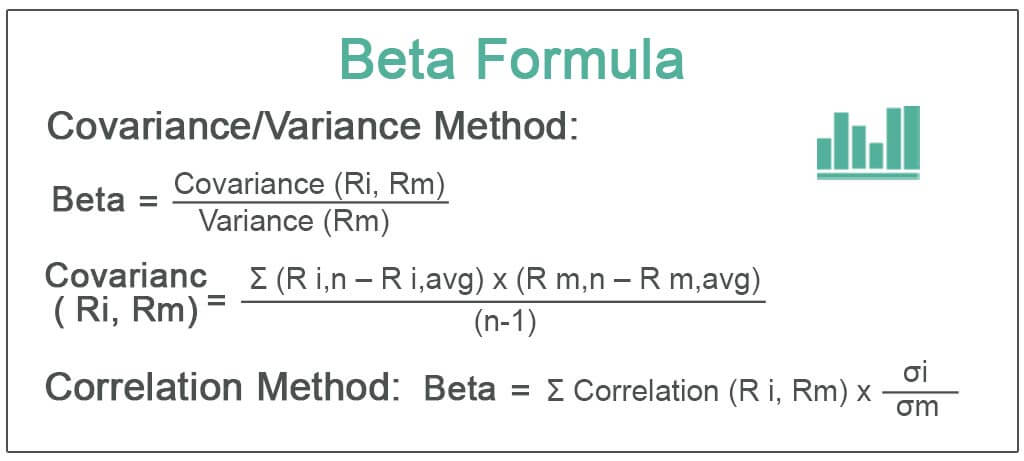

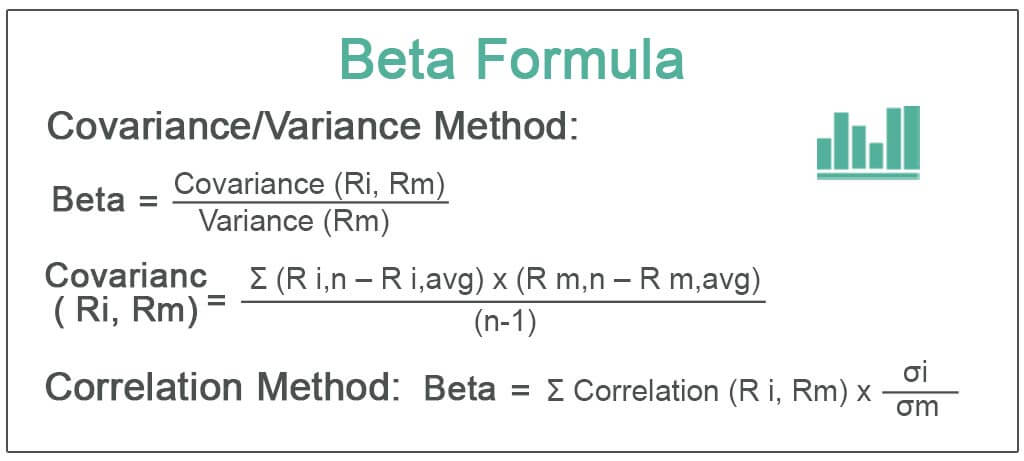

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

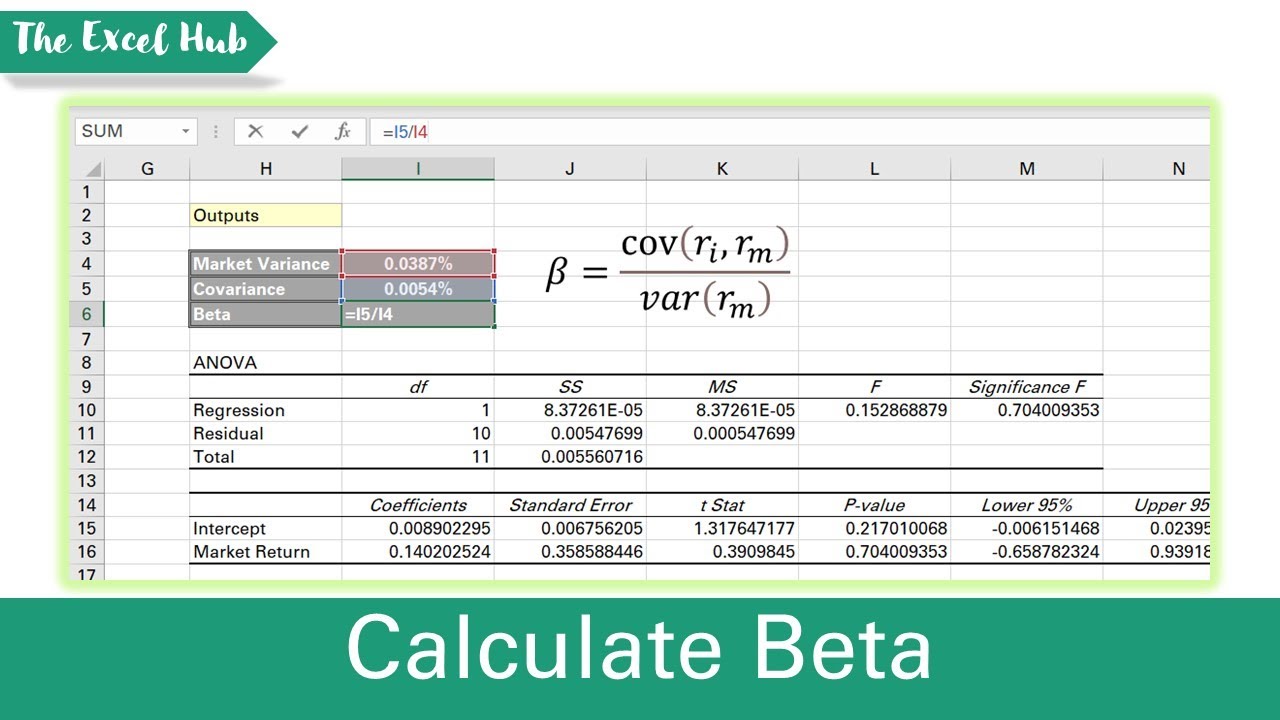

You can calculate portfolio beta on Excel using the SUMPRODUCT function.

. Calculate the value of each stock you own in your portfolio by listing the number of shares you have. Ad See how Invesco QQQ ETF can fit into your portfolio. The calculation 010 08 020 14 030 18 040 19 167 shows the portfolio beta is high relative to the market.

Ad See how Invesco QQQ ETF can fit into your portfolio. Portfolio analysis Beta. To determine the beta of an entire portfolio of stocks you can follow these four steps.

Where Re Stock Return. Hey everyone Ive constructed an EW Healthcare portfolio on python and quadruple checked my code. To calculate the beta of a portfolio follow the steps outlined below.

In this case we. VIX options and futures. Ad Access Portfolio Management Consulting Opportunities at Bank of America Private Bank.

Calculation of Beta by above Beta Formula-. The portfolios owner believes the market is going to rise. Step 4 Add together the weighted.

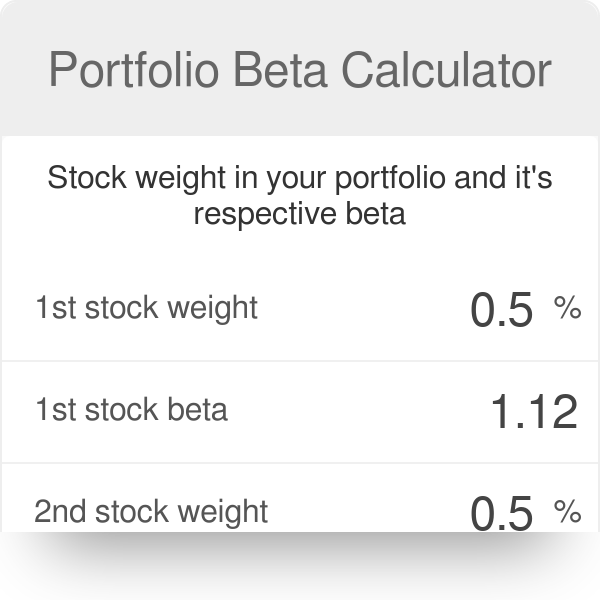

To calculate the portfolio beta you can use a portfolio beta calculator or you can apply the portfolio beta formula while guided by these steps. To compute the ex-ante beta we use current positions for a specific date and keep it unchanged in the calculation see the appendix for further details on the computation. Add up the value number of shares multiplied by the share price of each stock you.

Get past security price. Portfolio beta is an important input in calculation of Treynors measure of a portfolio. Then you take the weighted average of betas of all stocks to calculate the beta of the.

Formula Portfolio beta equals the sum of products of individual investment weights. Add up the value number of. Step 3 Multiply the stock beta by its weight to find the weighted beta.

We will us the linear regression model to calculate the alpha and the beta. We will us the linear regression model to. We can use the regression model to calculate the portfolio beta and the portfolio alpha.

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Hi Guys This video will show you an example how to calculate the Beta for a portfolio You own a portfolio that you have invested 2754 in Stock A 1301 i. Beta can be calculated using above beta formula by following below steps-.

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. We start with a brief beta definition in stock market context. Reflects the Beta of a given stock asset and.

Screen compare over 30000 funds across the industry. Ad Manage volatility w a tool that directly tracks the vol market. New And Experienced Investors Should Consider These Top-Recommended Brokerages.

We can use the regression model to calculate the portfolio beta and the portfolio alpha. Excels SUMPRODUCT essentially takes the sum of multiple products being the value of 2. As mentioned in the beta calculator the beta of a stock or the beta of a portfolio is a value that measures the extra.

Ad Start Growing Your Savings With Research Tools Provided By These Top-Reviewed Brokerages. Discover the Power of thinkorswim Today. Rm Market Return.

How To Calculate Beta With Pictures Wikihow

Calculate The Beta Of A Portfolio In Excel The Excel Hub Youtube

No comments for "How to Calculate Beta of a Portfolio"

Post a Comment